Indonesia’s state utility planner announced that it secured an extra 7.5 million tonnes of coal supplies on 4 January and will hold talks with government officials today regarding the country’s coal export ban.

This follows an announcement by the energy ministry that the government would seek an export ban on coal for January. On Monday, the Indonesian Government had said that the country was facing a “critical period” in its coal supply situation, citing concerns that insufficient supply at domestic power plants could result in widespread blackouts.

State power company Perusahaan Listrik Negara (PLN) had previously said it needed 5.1 million tonnes of additional supply for January to avoid widespread outages. PLN has said that while it had secured the additional supply required, it aimed to continue raising stockpiles to a usage level of 20 days.

“Coal power plants that have been in crisis are starting to see their supply issue being resolved,” Darmawan Prasodjo, PLN chief executive, said in a statement.

There has been no comment on whether the full export ban will continue until the end of January. Rory Simington, principal analyst for Asia Pacific coal research at Wood Mackenzie, said that a full-month ban could be averted by coordination across the country’s coal industry.

“A halt in Indonesia’s exports would have a major impact on thermal coal markets but a total ban for January is unnecessary and unlikely to be implemented in our view,” Simington said.

The Indonesian Coal Miners Association (ICMA) released a statement that the group was in discussion with the government to resolve the problem and working with members to fulfil domestic obligations.

One result of the export ban has been a surge in Chinese prices of thermal and coking coal futures on 4 January, the first trading day of 2022. The most active contract traded on the exchange rose as much as 8% on Tuesday compared to its Friday closing price.

Indonesia is China’s largest source of foreign coal. China imported 177 million tonnes of Indonesian thermal coal in the first 11 months last year, an increase of 54% compared with the same period in 2020.

Due to an ongoing trade dispute with Australia, China has become increasingly reliant on Indonesian thermal coal. The export ban, therefore, threatens China’s short term energy supply.

“The move could potentially have knock-on effects in China and India, which are the usual destinations for Indonesian coal,” said Warren Patterson, head of commodities strategy at ING.

However, experts see any long-term impact as unlikely, citing the mall volume of imports compared with domestic output and the country’s already expanded and stable coal production now. China is highly reliant on domestic output, with imports accounting for 10% of its coal supply.

In addition, since the second half of 2021, Beijing has taken intensive measures to increase domestic supply, with production capacity across the countries coal mines expanded to alleviate the impacts of the energy crisis.

After sales service: Visiting client's mining plant in Burma

After sales service: Visiting client's mining plant in Burma

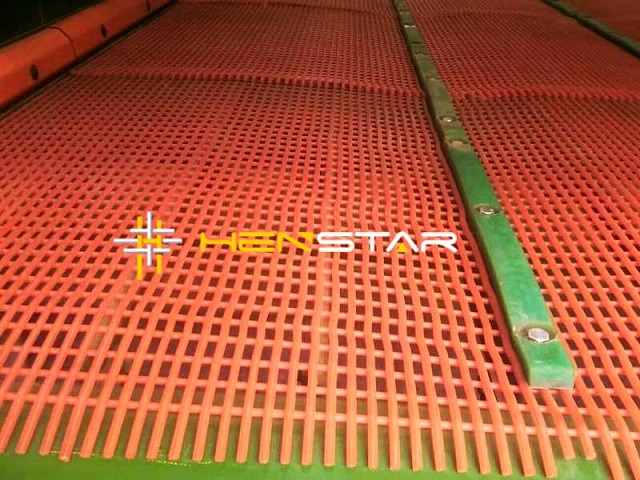

TPU tensioned screen mesh

TPU tensioned screen mesh

Mining companies may pause growth plans amid Ukraine war, inflation

Mining companies may pause growth plans amid Ukraine war, inflation

Henstar attach importance to Parkistan market

Henstar attach importance to Parkistan market